Personal Financial Advisor

Whether you’re looking to retire or are investing in a new business, a personal financial advisor can help you prepare. At Omega Wealth Management, we understand that life isn’t all about money; we deliver customized financial strategies that are tailored to your values and timeline. Our personal financial advisors provide support with asset management, tax planning, investments, and insurance. Our “How We Can Help” section of our website reflects our tailored approach to financial advising. Ready to learn more about our personal financial advisor services? Start by booking a complementary 15-minute conversation, or read more about our experienced team.

A personal financial advisor can provide help with:

Tax, estate, and trust planning

Selling or purchasing assets

Tax planning

Estate planning

Retirement planning

Investment planning for retirement, education and other major goals

Need help getting started? Learn more about the Omega Method, a comprehensive approach that integrates your values, vision, and wealth. Or sign up for our newsletter for the latest financial management tips and updates.

Personal Financial Advisor Services

Omega Wealth Management is a comprehensive financial management firm. Every service starts with a strengths assessment and an exploration of your most important life and financial goals. We offer a flexible, phased process that meets you where you. Our services include a written plan, investment strategies, and one-on-one time with your personal financial advisor. Read more about our customizable client journeys:

The Life + Wealth Integrator™

The Life + Wealth Integrator™ tool helps clients compose a plan that centers around their values and goals. Our personal financial advisors will explore what you want to achieve and what’s most important to you before presenting a program that comprehensively integrates your vision, values and wealth. The Life + Wealth Integrator™ process can be used to support cash flow analysis, plan for taxes, build an investment strategy, and determine insurance needs. In addition, your personal financial advisor will deliver ongoing advice to help you navigate life’s unexpected twists and turns. The Life + Wealth Integrator™ service includes semi-annual meetings with your personal financial advisor to ensure your goals are on track and address unexpected issues.

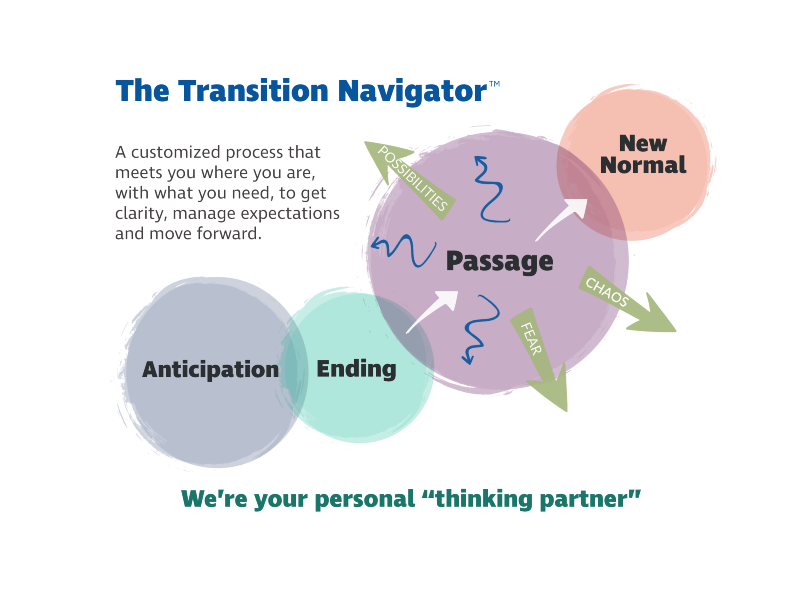

Transition Navigator™

Many of life’s transitions are accompanied by a change in finances. A personal financial advisor can help you navigate the personal and financial shifts that accompany getting married, having children, or retiring. By acting as a “thinking partner”, your personal financial advisor will simplify economic decisions while you enter a new phase of life, whether expected or not. We begin the process with a detailed discussion of what your “new normal” might look like, then review financial options that best meet your needs. If you have an upcoming change to your family, income, or business, connect with our team to see how the Transition Navigator™ service may help.

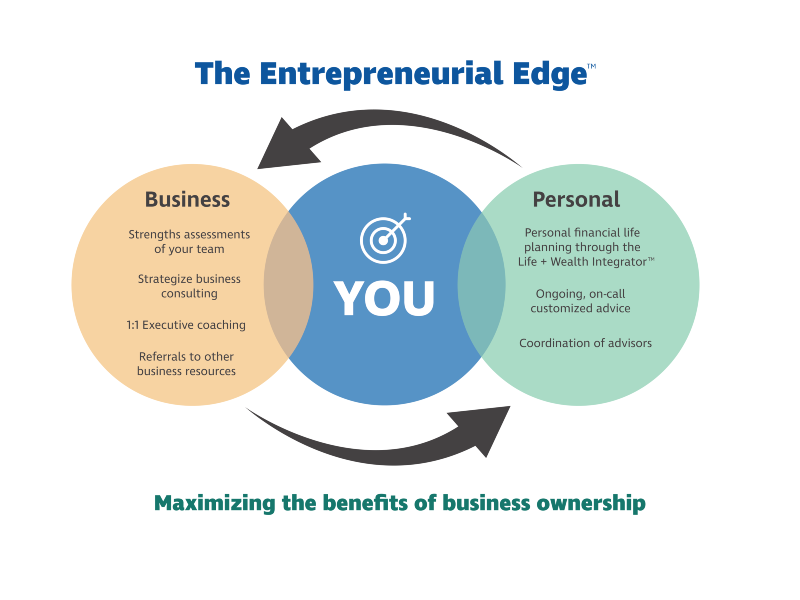

The Entrepreneurial Edge™

This flexible service is designed for active business owners and entrepreneurs. As a business owner, you may not have the time to assess your portfolio or plan for retirement. By integrating the benefits of business ownership with your life priorities, our personal financial advisors present options that support your current and future well-being from both a business and personal perspective. The Entrepreneurial Edge™ program includes exercises and assessments to maximize your business ownership, as opportunities for coaching with Lisa Kirchenbauer, Founder & President of Omega Wealth Management, LLC and an entrepreneur with more than 20 years of experience.

The Omega Method

At Omega Wealth Management is a holistic and comprehensive approach that starts with understanding your personal goals and dreams. Then, we integrate your values with your financial strategy. We review your entire financial portfolio, including cash flow, taxes, retirement, investments, and insurance. In addition, your personal financial advisor will look for opportunities and areas of coordination with other professional advisors that will support your overall goals. Learn more about The Omega Approach or schedule a 15-minute conversation with our team.

An Independent & Fiduciary Firm

As an independent firm, our personal financial advisors are not affiliated to any one investment partner. This allows us to choose funds that best fulfill our clients needs. As fiduciaries, our team can only recommend options that are in our client’s best interests. Omega Wealth Management is a fee-only practice; we do not receive commissions from the investment plans we offer. Our personal financial advisors hold the following certifications:

- Certified Professional Facilitator (CPF™)

- Registered Life Planners (RLP®)

- Certified Financial Transitionist (CeFT®)

- Certified Financial Planner (CFP™)

- Certified Investment Management Analyst (CIMA®)

- Certified Financial Planner (CFP™)

- Certified Financial Transitionist (CeFT®)

- Registered Life Planners (RLP®)

- Certified Investment Management Analyst (CIMA®)

Omega Wealth Management provides several resources to support our clients, including our blog, newsletter, and frequent opportunities to connect with your personal financial advisor. Connect with our team to learn more about your financial options today.

Ready to start your financial planning journey?

Ready to start your financial planning journey? Connect with our team in a free 15-minute call today.

Just for You

Knowledge is power! Stay up to date with the latest tips, tricks, and trends that people in the know use to make the most out of what they’ve got.