By Jared Jones CFP®, CIMA®, CeFT®

Over the last 12-months some new trends in the investment world have started to emerge. That’s to be expected when you go through a paradigm shifting event like COVID. We can look back over past market crisis and see plenty of new trends emerge – most recently, the rise of index and ETF investing which came out of 2008/2009.

The lexicon of investing has added some new terms over the past few months. If you haven’t been keeping up I’ll review a few here, some of which may wind up being trends for years to come.

- SPACs – SPAC stands for Special Purpose Acquisition Company. They have been around for decades but have seen an explosion in the last 6-months. Shaquille O’Neil and Colin Kaepernick have even opened their own SPACs. The easiest way to think about a SPAC is in the same family of venture capitalism. SPACs are shell companies that look to raise capital through their own initial public offering (IPO), and then merge with an existing private company. This allows the private company to circumvent the traditional IPO process and get a similar result of raising capital, without worry of swings in broader market sentiment. It also allows the private company being acquired to provide forward looking guidance, something that’s prohibited by the SEC in traditional IPOs. Some popular companies that have been recently acquired by SPACs include 23&me, SoFi, and PaySafe.

- Meme Stock Trading – The reddit forum r/wallstreetbets has existed since 2012, but it made major headlines earlier this year with the events that took place around GameStop. Users of the forum saw an outsized bet that GameStop stock would go down hedge funds, and they looked to pounce and drive the price up causing massive losses for the hedge funds. The attempt ultimately lost steam, but it left a lot of people worried that this would become a new norm. There’s nothing inherently new about internet forums pumping up certain stocks. We’ve seen that since the advent of the internet, and it played a big role in the dot-com bubble. The idea of this being a more systemic issue of irrational exuberance began to creep into the minds of investors. Compared to the overall market, the recent events in GameStop aren’t enough to move the needle to cause larger issues. That’s not to say one day in the future it couldn’t happen. Young people today grew up communicating on the internet, and the way they invest is bound to be different than older generations. Do these viral moments like we see on social media creep into the investment world. A recent survey by Yahoo Finance reported that 28% of Americans purchased GameStop or another viral sock in January. It’s something to keep an eye on. At this point no one is sure if ever see the events that led to GameStop replicated or if we’ll see new regulations put in place to make it much more difficult.

- Asset Class Rotation – this a term that’s been getting a lot of attention in the investment world. It’s a fancy way of saying what’s worked in the past is starting to change. For awhile last year the only game in town was the S&P 500, especially the big boy tech companies like Facebook, Amazon, Google, and Microsoft. Staring in the 4th quarter last year we saw small companies begin to pick up steam. The Russell 2000 (index measuring small stocks) was up 5% at the end of January, with a 3-month trailing return of 35.15%. By comparison the S&P 500 was -1% at the end of January, with a 3-month trailing return of 14.05%. Things are definitely beginning to shift, and as we always say diversification is critical. It’s never clear exactly where the puck is going so it’s best to hold as much of “the ice” as possible. International and emerging market stocks have also picked up steam recently.

- Bitcoin – the last topic I waned to touch on is Bitcoin. Bitcoin isn’t new either, but it too has seen a massive explosion in the wake of COVID. Recent news of Tesla, one of the most innovative companies in the world, and BNY Melon, the oldest bank in America adding Bitcoin to their balance sheets has added fuel to the rally. In mid-February the cryptocurrency passed $50,000 for the value of 1 Bitcoin. As a technology Bitcoin is very interesting. It has the potential to revolutionize the finance world, but it’s still very early in it’s life. As an investment it’s unpredictable and we view it as a risky asset class. It is important to note that the IRS views BTC as an asset, not a currency, and is looking for ways to track and tax income derived from cryptocurrency. We continue to advise OWM clients not to invest any money beyond what you’re willing to lose, and to consult a tax professional if you are interested in pursuing holding cryptocurrencies.

By no means is this a comprehensive list, but it’s what has caught my eye to start 2021.

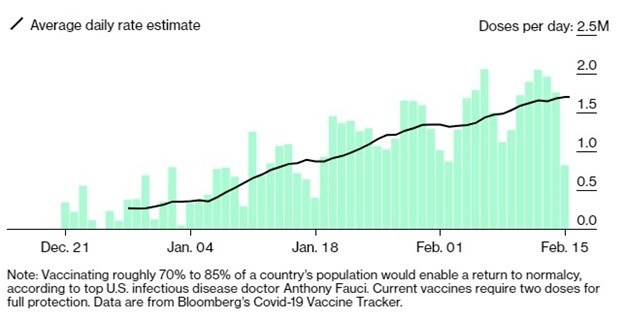

Closing out with some encouraging news, it looks like the vaccine rollout is gaining some legs. It was a rough start, and some kinks are still be worked out, but things are improving day by day. In my view this is the single most important factor to keep an eye on for both market and economic outlooks.

This commentary is provided by Omega Wealth Management, LLC for educational purposes only, and is not meant to be financial advice. Non-clients of OWM should speak with their advisor before making investment decisions. Client’s of OWM may maintain positions in securities discussed in this commentary. This commentary represents a view of the markets at a specific point in time and is not intended to forecast future events or guarantee results. Past performance is no guarantee of future results.